Expat Banking - Personal Finance For the Intrepid Investor Here at Q

Wealth we often receive emails and calls from people who are confused about how to manage their finances once they become expats or non-residents. I'm not talking so much about tax preparation or returns, but rather about the practical aspects of banking across borders. For example: Do you need an offshore bank account? What is the difference between a multi-currency account and multiple currency accounts? Should I keep my money in the country where I am living? Can I still access my online brokerage account from overseas? These are all typical questions we are asked, and I will answer these and more in this article. Let's make up two typical composite characters, Bill and Mary Expat, who are retiring early abroad and planning to travel frequently. To make things easy, let's say they are American. They have decided they like the laid-back lifestyle of Latin America, but they are still wavering between retiring in one of the more popular expat havens like San Miguel de Allende in Mexico, or Bocas del Toro in Panama... or maybe they would like to go to a more exotic, adventerous place like Columbia or Brazil. They don't know yet. Either way, getting there is half the fun, and Bill and Mary are determined to enjoy the journey. For the moment, they are going to up stumps and travel! Bank Accounts and ATM Cash Withdrawals Bill and Mary are starting out on their journey with a few accounts at banks in their home country, the USA. Like most couples, they have a couple of joint checking accounts, a savings account, a credit union account and a few credit cards. It's certainly worth keeping these home country accounts. US checks are still useful in many Latin American countries, where they can be cashed at the friendly neighborhood casa de cambio. This is a good way to access cash for things like daily living expenses or home improvements. Typically the casas de cambio give a better rate of exchange than ATM machines without charging any fees, and without being subject to daily limits. But of course, before they will cash checks for you on the spot, they must know you. It is best to referred by an existing client, so ask around the "expat experts" in your chosen area. US bank accounts will also be useful for paying bills at home. Regular bills like insurance payments may be debited automatically, while one-off bills might be best paid by mailing a check. Regular income like social security checks can be direct deposited into the US checking account. Many people don't even know they have daily cash withdrawal or spending limits on their ATM or credit cards until the day they urgently need a reasonably large amount of money. Scared of building up a large amount of cash at home, they wait until the last minute to withdraw funds, assuming that because they have the money in their account, they can withdraw it using their debit cards. Big mistake! They have to pay their builders in cash and the cash dispenser refuses to spit out the money. In addition to that, many countries have just one or two ATM networks and these networks automatically impose their own daily limits. It's important to understand in this respect that there are actually three different types of daily limits you must contend with: o Daily cash withdrawal limit imposed by the bank that issues the card o Daily purchase limit imposed by the bank that issues the card - this applies to non-cash purchases, where you sign a card purchase voucher in a retailer. o Daily cash withdrawal limit imposed by the ATM network owner - this limit is not set by your bank, but by the owner of the actual cash machine where you are conducting the transaction. That is to say, you can ask the bank that issues your card for a permanent or temporary increase in your cash withdrawal limit. They might set it at $50,000 a day. But most ATMs don't pay out more than about $500 in one transaction. In this case as far as your card issuer is concerned, you could do 100 transactions of $500 each per day, before you hit their limit. ATM network owners set their own limits, for a variety of reasons. In Brazil, for example, things are particularly difficult. Withdrawals at night are limited to 50 reals, whereas a taxi across Sao Paulo can easily cost 150 reals. So if you are arriving in Sao Paulo on the red-eye flight, be sure to bring cash and don't rely on local ATM networks! Argentina and other countries place similar restrictions on ATM withdrawals. In some countries each bank has a different network. In other countries (Spain for example) you may find one monopoly network that controls virtually all the cash machines. They are the worst! If the network owner says nobody may withdraw more than say $500, their word is law. It doesm't matter that the card issuer allows you to withdraw $50,000. You will get $500 a day, no more! Internet Purchases and Credit Cards When you are starting out in a new country without any established credit record, and as a new, recent arrival resident, it may be hard to obtain a credit card. So it is well worth keeping credit cards from your home country too. But there are a few tips and tricks for playing the cards correctly. First, inform your card issuer that you will be traveling. Call them in advance. That's important because these days, all transactions from abroad are viewed with suspicion by automatic tracking software used by all the banks. If your bank doesn't know you are abroad, the software will most likely prevent you from suddenly spending $500 in Panama. This would, of course, be rather embarrassing if you are just leaving a restaurant with prospective business partners at midnight Panama time, early morning Eastern when your bank is closed, and you were relying on the card to pay the bill. It's also worth keeping a US billing address. This may be a PO Box or a private mailbox street address provided by an outfit like The UPS Store or Pakmail. You can get a phone number to go with it from a VOIP provider like Skype. This is important. Although your bank might be happy to mail statements to a foreign address, about 99% of online retailers are not set up to handle US cards with non-US billing addresses. Their systems will automatically detect from the card number that the card is issued in the US, then the same system will require an AVS (Address Verification System) match. AVS only works with US addresses. So if you have a US-issued card with a non-US billing address it is basically useless for internet purchases, and also for any other purchases where your ZIP code is requested (some gas stations in the US for example) Equally, you should be aware that the unique IP address of each computer on the internet, allows the merchant to see what country the order is being placed from. If you order something that is popular with card fraudsters (like a new laptop, a digital camera or gold jewelery) using a US card, US billing address but a Panama IP address, the transaction will most likely be flagged as potentially fraudulent. Usually in cases like this, you need to pick up the phone and talk to the merchant directly to explain the circumstances, so they can manually override their fraud procedures. Most merchants will be happy to do this, but some simply won't budge. Opening a Local Bank Account At some point you will most likely find you need to deal with the local banking system in the country you are moving to. For example, in most Latin American countries now you can pay your utility bills online rather than standing in line for 45 minutes to pay in cash. But you will need a local bank account to do this. Bank account opening procedures vary enormously from country to country. Unless you are moving to a known 'tax haven' the banking system will probably be geared towards locals, and you might find that you have to demonstrate official residence by means of a permit or local ID card before you are even allowed to open a local bank account. There are often exceptions to these rules - but local bank staff in small-town branches will probably not be familiar with them. It's best to ask local expats for their recommendations, and to choose a bank and branch that is accustomed to dealing with expats and foreigners. Either way, before you leave home try to get several copies of a bank reference from your home bank addressed "To Whom it May Concern" and stating that you have been a client for a number of years and that have always operated your account in good standing. These documents will prove very useful when dealing with foreign banks, both local and offshore. If your home bank says they want to address a reference to a specific bank, explain that you are travelling and are planning to buy property overseas, but you don't yet know in which country you will end up. It's not just the account opening procedures that vary a lot depending on the country you go to. So do the services offered, which may be significantly different from what you are used to at home. Make sure you take the time to understand the terms and conditions of operation related to your new account, otherwise your bank might assume one thing while you assume something totally different. For example, how long do you have to wait after making a deposit before you can write a check against it? Some countries have complicated systems of value dates where money might show up in your account even though it is not available for you to spend. If there's anything you don't understand, ask your bank. Do you need a Private Offshore Bank Account? Banking services vary widely, but are rarely of very high quality. You should probably therefore consider opening an account at an offshore bank that specializes in dealing with non-residents. You can open this in a neutral third country - places like Switzerland, the British Channel Islands, Singapore and Panama are typically good. Big names like Barclays Wealth and HSBC offer these services, as do a multitude of smaller banks. Even in this day and age it should be possible to open non-resident bank accounts by mail, without the need to travel there. You can then operate the account using internet banking and debit or credit cards. There are two main reasons why you might want to open an offshore account. The first is for convenience - you will be dealing with a sophisticated private banker who speaks your language and can offer the range of international services that you will demand. The second is for privacy and asset protection - offshore banks offer confidentiality and discretion. As you become non-resident of your home country for tax purposes, you will gain substantial tax advantages by moving your money offshore. One of the convenient services most offshore banks offer expats is the multi-currency bank account. This allows you to keep various currencies in the same account. For ease of use you have just one account mnumber, but you can keep all major currencies there and switch them at will with the click of a mouse. Another useful service is the so-called InvestLoan which allows you to borrow money in one currency at a low rate of interest, then re-invest it in a higher interest currency to make a profit. Of course this doesn't necessarily apply if you are moving to a banking center like Panama or the Cayman Islands, but if you are moving to a high tax bureaucratic country like Mexico, Brazil or almost anywhere else in Latin America, you don't want to put all your assets into the domestic banking system where the government can see them on the radar. Neither do you want to leave them in your home country like the USA which will also try to tax you on those assets! Another consideration when opening your offshore account is whether to open a personal or corporate account. If privacy is a concern for you, it is generally worthwhile forming an offshore corporation and holding the account in the name of the corporation instead of your personal name. This helps keep your account under the radar, as transfers in and out will not show your name. If you would like to open a private or company offshore bank account, there are consultants who can help you. They will explain a number of do's and don'ts, and also direct you to specific banks that you can contact directly in order to open accounts. They can also tell you which banks will open accounts for offshore corporations. A separate brokerage account is usually a good idea too, since most online offshore banks do not offer great brokerage facilities. But there are some. I know, for example, a European-owned offshore discount brokerage house based in Panama that allows you instant online access to major world markets such as New York, London and Frankfurt. Englishman Peter Macfarlane is an author and lecturer on offshore finance, investment, due diligence and wealth creation matters. After fifteen years advising high net worth clients on offshore asset protection structures such as companies, trusts and private interest foundations, he decided on a career change and now mentors individuals who are interested in creating, preserving and growing wealth in a secure offshore environment. Peter defines wealth in the broadest sense, believing that money is worthless if you don't have health and happiness. He is now joint editor of The Q Wealth Report, a publication dedicated to publishing freedom, wealth and privacy information for a select audience. More detailed articles about international living are available at the Q.

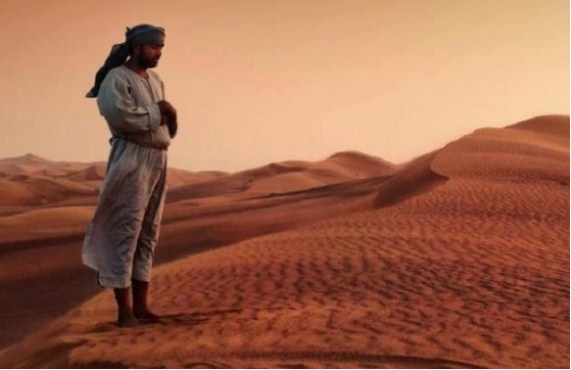

Home » Al Fatihah Dalam Sholat

» Hati-Hati! Jika Tersalah Bacaan Surah Al-Fatihah, Kita Akan Tersebut Nama-Nama Iblis Dan Syaitan Di Dalam Solat! Jangan Ambil Mudah!