How To Talk To Sellers In Real Estate Investing With Seller Financing

First off, there are some subliminal things you have to learn how to do. When I say subliminal, there are some basic sales tactics that work in any type of sales environment, especially in real estate. One of them is association. You have to let your sellers know that people do this. This is a regular thing. It's not this big unheard of thing for someone to sell with seller financing. If you have done this in the past, talk about this. Mention about doing this in the past. People also want to do what other people do. If they know other people are doing it, they will feel good about doing it. Let the seller know that people do this all of the time, lots of people do it, then they will be more likely to do it. Unfortunately, we have a herd mentality. A lot of times we have to see that someone else did something first, then we have permission to do it. Also, you want to have some fear of loss, indirectly, in the tone of your voice. You want to make it sound like this is the only way you can do this deal. In a lot of cases, this is the truth, so you're not lying to anybody. Let them know that. Be indifferent about it. You have to have an attitude about you that there are other houses you can buy, especially in this market. Make them feel that they are going to lose something if they don't go ahead with the sale with you. Now, let's get into the topic itself. There are some things you can do to sway the seller into going your way. One of them is to offer them a good interest rate. In most of these cases, we are buying these houses, not for a long-term deal, maybe to have it for a couple of years with a lease-option tenant in it to pay it off, or just looking to buy it for a short period of time to fix it up and maybe sell it. Or perhaps, we are just looking to get it under contract to sell it to someone else. So, offer a nice interest rate. Offer an interest rate that makes it attractive to the seller to give you seller financing, to trust you. You are not going to have it that long. That extra 2, 3, or 4, percent is nothing. I'll pay 15 or 20 percent interest if I have to if the deal is right, just to get the deal under my belt and make some money on it. If you are only going to make 3 or 4 payments on it, what's the difference if you are paying 20 or 25 percent on it? It's only going to be an extra couple of hundred dollars. If the deal is good enough to take, it's good enough to take with a higher interest rate. Don't make the mistake of financing at the same rates the banks give. Another tip for you if someone is uncomfortable is to offer them a balloon. A balloon on a mortgage means that the mortgage is going to be paid in full by a certain amount of time. So, a mortgage with a 3 year balloon guarantees the seller that in 3 years or sooner, we are going to pay that mortgage off and they will have all of their money. It also allows them to defer their taxes. If they sell their house today for cash, and they get their HUD, and they go to closing and they get that full amount, they are liable to pay taxes on the full amount of their profit. (Make sure your accountant double checks this for you on an individual basis). When they sell you the house with owner financing, they don't have to pay taxes on the whole amount, because they don't get the full amount. It allows them to defer their taxes for a year or two, or until you pay the loan off in full. Also, they are acting as a bank. I have told sellers that the people that are making money in selling houses are usually the banks. I tell them that they will be in a position like a bank, and they will earn a lot of interest on their property. I add it up and tell them how much profit they will be making on the deal. For example, it's a $200,000 house and I'm giving them 8% interest. That's a $1,467 dollar a month payment. Let's say I make that payment for 2 years. At the end of 2 years, on that $200,000 house, I'm going to owe about $197,000 or so. So, I will show him in a year, it equals $17,000 that I have paid him. If it takes me 2 years to pay you off, I will have given you $35,000 on your house, and I'm still going to owe you $197,000. Let him know that he will end up selling that house for $237,000 because of my monthly payments and the amount due at payoff. Not the original $200,000 on the contract. Explain that that is how the banks make their money. Point out to him the real dollars that he will be getting over a period of time. On an interest-only loan, you will be giving them interest every month after month. At the end of the loan, you will still owe them the full amount. If it's a $250,000 house and they are giving me an interest-only loan on the house, I still owe them $250,000 whenever I pay it off. So, everything I give them up- front is money in their pocket. Make sure you tell them that the whole payment every month goes right into their pocket no matter when I pay this off, I will STILL owe you the full amount of the loan. It's a good deal for a seller. And it's the truth. That's how the mortgage companies and banks make A LOT OF MONEY! That's why some investors quit investing after a period of time when they put a million dollars in their accounts and become hard money lenders. They become private lenders and make a lot of money for NOTHING! In a lot of cases, you will have a seller that will go with owner financing, but needs some money NOW. Point out to them that if you give them $20,000 now, and pay off the difference, they are going to have to pay taxes on that $20,000 (again, double-check with your accountant about this). Suggest this to them if the home is paid in full: So they can save money, they can instead go get a loan/mortgage on the house for $20,000. You can put that $20,000 in your pocket right now. I will then make the payments on that loan until we sell the house and I pay you off in full. And right now, you don't have to pay taxes on that $20,000. This is a great way if they want some money now. Here's a tactic that works and will continue to work. Once you get a deal on seller financing for a house that is selling for $300,000 and it has a 5 year balloon, tell the seller that within 5 years or sooner I will pay you off. If in the near future, I have someone ready to buy that house, I'll call the seller and tell them that you have some extra cash, offer to pay about $250,000 for that home RIGHT NOW. Guess what. That $250,000 today is better than $300,000 in 4 or 5 years, and you have just make $50,000! If they make a counter-offer for a little more, tell them you will think about it, wait a day or two, call back and accept their offer. There are lots of ways to make money in this business. The bottom line is: MAKE AN OFFER. You have to believe that people are going to accept your offers. Don't think for a minute that just because maybe you don't own your house outright, that a lot of other people don't. I own a house outright. I can borrow money against it, I can rent it. In any case, make an offer. There are many people out there that own houses that are paid for, and they are just sitting there. Make the offer, look them in the eye, pitch them high, and watch them buy. Believe in yourself!

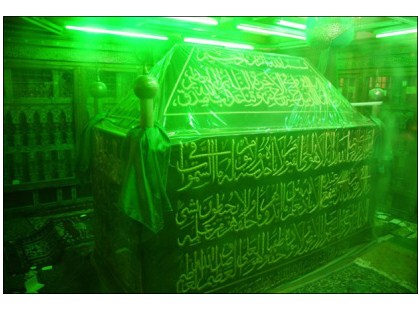

Home » Kisah Wafatnya Imam Syafie

» Kebanyakan Kita Bermazhabkan Imam Shafie..Namun Tahukah Kita Bagaimana Kisah kewafatan Imam Syafie yang Amat Menyedihkan